What is Yield Farming?

The Search for A Market Edge

COMP tokens distributed by Compound arguably started this whole trend of luring in liquidity providers with the promise of governance tokens in exchange for parking their crypto.

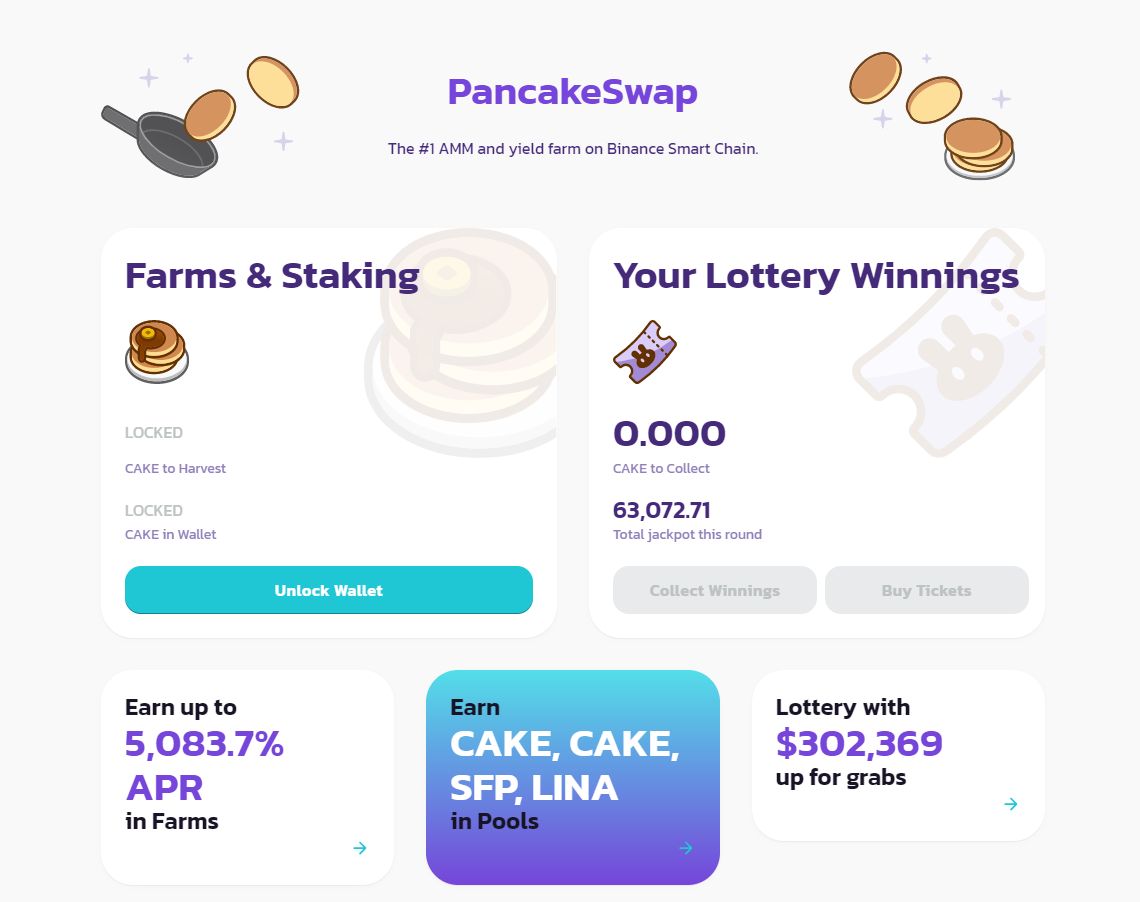

Yield Farming is a term coined in the defi space, and refers to the concept of maximizing profits and finding edges through borrowing from defi protocols for the purposes of reinvesting with higher leverage, liquidity mining to supercharge gains from liquidity pools, and moving money quickly across pools to take advantage of arbitrage opportunities.

This guide looks to keep the party going, not by trying to predict what new strategies are going to come out for liquidity providers, but where and why to get started with the newer and better protocols to piece together your Defi farming monopoly.